Projects that can increase -- or decrease -- the value of your home

Canadians are investing in home improvement like never before. While most plan to spend reasonable sums, others say they'll go all out: luxurious materials, home theatres, a Jacuzzi on the patio...even $60,000 kitchens are not that unusual! But how much of their investment will be recovered when their house sells?

Canadians are investing in home improvement like never before. While most plan to spend reasonable sums, others say they'll go all out: luxurious materials, home theatres, a Jacuzzi on the patio...even $60,000 kitchens are not that unusual! But how much of their investment will be recovered when their house sells?

Homeowners tend to embark on renovation projects to meet their needs, improve their quality of life or simply pamper themselves with a little luxury. But even if you're renovating primarily for your own sake, you should try to assess the post-project increase in the value of your house, just in case you ever want to sell. There is also the fact that a renovated house will

…

Buying an investment property is a popular option for Canadians looking at different ways to invest their money.

Buying an investment property is a popular option for Canadians looking at different ways to invest their money. How much of a mortgage do you qualify for? You went to your bank and they told you $xxx,xxx – are they right? Your dream house costs a bit more, so is there any way to get the extra funds? If the property has a rental suite, and you have a good mortgage broker on your side, the answer is likely “yes”.

How much of a mortgage do you qualify for? You went to your bank and they told you $xxx,xxx – are they right? Your dream house costs a bit more, so is there any way to get the extra funds? If the property has a rental suite, and you have a good mortgage broker on your side, the answer is likely “yes”.

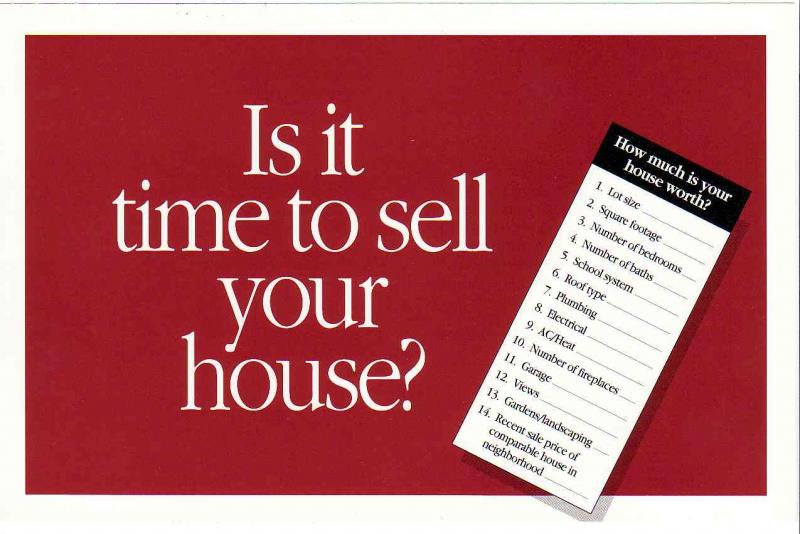

It is a seller’s market. But not every house will sell. What is the best strategy for home sellers selling their home in a seller’s market?

It is a seller’s market. But not every house will sell. What is the best strategy for home sellers selling their home in a seller’s market?

If you fall in love with a fixer-upper, you may find yourself in a tough spot figuring out how to pay the mortgage and cover the cost of renovations or postponing renos until you can afford them.

If you fall in love with a fixer-upper, you may find yourself in a tough spot figuring out how to pay the mortgage and cover the cost of renovations or postponing renos until you can afford them.

It's time to cash in for many Canadians who bought property from 2008 to 2011 in the United States, says Diane Olson, an Arizona real estate agent and former Winnipegger.

It's time to cash in for many Canadians who bought property from 2008 to 2011 in the United States, says Diane Olson, an Arizona real estate agent and former Winnipegger.

Is It Possible to Get a Mortgage with Bad Credit in Canada?

Is It Possible to Get a Mortgage with Bad Credit in Canada?

With the upcoming preparation and approval of its budget next month, the British Columbian government is set to tackle housing relief as a primary concern.

With the upcoming preparation and approval of its budget next month, the British Columbian government is set to tackle housing relief as a primary concern. Q: How do I renegotiate with my home's buyers over problems arising from their home inspection?

Q: How do I renegotiate with my home's buyers over problems arising from their home inspection?

Spring and all its glory is right around the corner—just take a look at the signs all around you.

Spring and all its glory is right around the corner—just take a look at the signs all around you.