A shortage of available homes for sale has certainly made it easier to sell a vacant home.

However, the same pitfalls that relate to selling empty houses more quickly, and at best price remain. For sellers who have experienced a job change or other event which requires they move and leave a vacant and unfurnished home behind to sell, there are often issues requiring special consideration. That's because many folks buy on emotion and have a hard time warming up to an empty house. A lived-in home can be much more appealing.

However, the same pitfalls that relate to selling empty houses more quickly, and at best price remain. For sellers who have experienced a job change or other event which requires they move and leave a vacant and unfurnished home behind to sell, there are often issues requiring special consideration. That's because many folks buy on emotion and have a hard time warming up to an empty house. A lived-in home can be much more appealing.

Empty homes often present an echo when you walk through them, and because doors and windows aren’t opened to allow air to circulate, odors can accumulate.

So, you are selling a vacant home, what can you do to create an edge

…

While Vancouver is continuously ranked one of the best places in the world to live, the affordability of our city seems to plummet every year. With the 2015 B.C. Assessment Roll issued earlier this month, the cost of living is confirmed to be higher this year than ever.

While Vancouver is continuously ranked one of the best places in the world to live, the affordability of our city seems to plummet every year. With the 2015 B.C. Assessment Roll issued earlier this month, the cost of living is confirmed to be higher this year than ever.

As the Canadian real estate market continues to rise, some investors want to put their RRSP money to work in a real estate investment. While there are limitations, there are also several options available to investors.

As the Canadian real estate market continues to rise, some investors want to put their RRSP money to work in a real estate investment. While there are limitations, there are also several options available to investors.

How much of a mortgage do you qualify for? You went to your bank and they told you $xxx,xxx – are they right? Your dream house costs a bit more, so is there any way to get the extra funds? If the property has a rental suite, and you have a good mortgage broker on your side, the answer is likely “yes”.

How much of a mortgage do you qualify for? You went to your bank and they told you $xxx,xxx – are they right? Your dream house costs a bit more, so is there any way to get the extra funds? If the property has a rental suite, and you have a good mortgage broker on your side, the answer is likely “yes”.

Cracks in the foundation, ceiling or walls are worrying. Sometimes they’re signs of trouble, while often they’re just cosmetic issues.

Cracks in the foundation, ceiling or walls are worrying. Sometimes they’re signs of trouble, while often they’re just cosmetic issues.

Many governments across the country are putting the final touches on their 2016 legislative agendas, including British Columbia’s. And on the West Coast it will probably be difficult to disconnect many of the announcements and policy directives from the provincial election just more than a year away.

Many governments across the country are putting the final touches on their 2016 legislative agendas, including British Columbia’s. And on the West Coast it will probably be difficult to disconnect many of the announcements and policy directives from the provincial election just more than a year away.

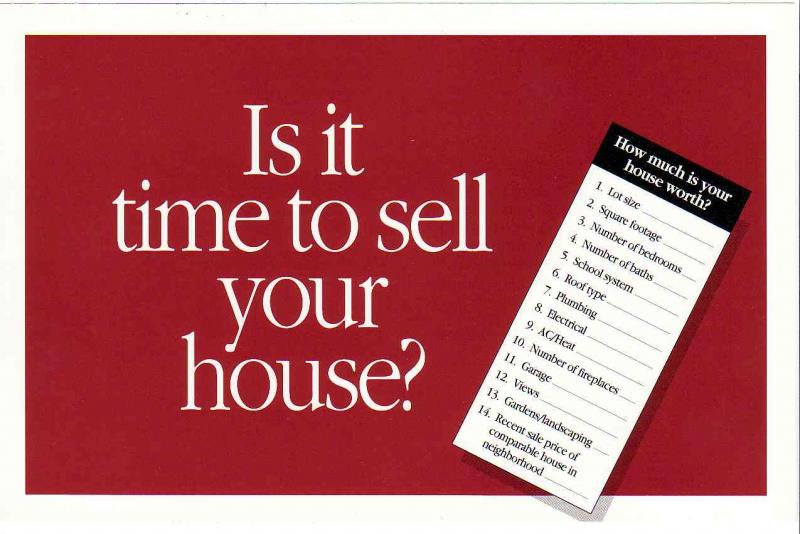

It is a seller’s market. But not every house will sell. What is the best strategy for home sellers selling their home in a seller’s market?

It is a seller’s market. But not every house will sell. What is the best strategy for home sellers selling their home in a seller’s market?

If you fall in love with a fixer-upper, you may find yourself in a tough spot figuring out how to pay the mortgage and cover the cost of renovations or postponing renos until you can afford them.

If you fall in love with a fixer-upper, you may find yourself in a tough spot figuring out how to pay the mortgage and cover the cost of renovations or postponing renos until you can afford them.

It's time to cash in for many Canadians who bought property from 2008 to 2011 in the United States, says Diane Olson, an Arizona real estate agent and former Winnipegger.

It's time to cash in for many Canadians who bought property from 2008 to 2011 in the United States, says Diane Olson, an Arizona real estate agent and former Winnipegger.