Mortgage Terminology - Kamloops Property For Sale

Posted by Steve Harmer on Wednesday, February 10th, 2016 at 8:23am.

Mortgage Terminology

To Understanding common Mortgage Terminology we have to start with the basics:

What is a mortgage?

A mortgage is a word that has been in the English language since the late 1300s and comes from the French “mort,” which means “dead,” and “gage,” meaning “pledge.” Therefore, a mortgage, in the real sense of the meaning of the word, means that the security pledged to the mortgagee for the debt will be taken from him if he fails to pay the debt, and will, therefore, be “dead to him upon condition.” on the other hand, the mortgagee fulfills the obligation to pay the debt, the pledge is dead. Either way, something dies.

A mortgage is a word that has been in the English language since the late 1300s and comes from the French “mort,” which means “dead,” and “gage,” meaning “pledge.” Therefore, a mortgage, in the real sense of the meaning of the word, means that the security pledged to the mortgagee for the debt will be taken from him if he fails to pay the debt, and will, therefore, be “dead to him upon condition.” on the other hand, the mortgagee fulfills the obligation to pay the debt, the pledge is dead. Either way, something dies.

A dictionary definition is much simpler and tells us that a mortgage is a “temporary, conditional pledge of property to a creditor as security for the performance of an obligation or repayment of debt.”

It is also important to Understanding Mortgage Terminology to know who The Players are:

It may feel as if you need a program to keep track of all the folks who play a part in your mortgage drama, especially if this is your first experience with this type of loan. Let’s take a look at just who these players are and what their roles are.

Mortgagee:

More commonly known as “the lender,” the mortgagee is the lending institution that provides the mortgage.

Mortgagor:

The mortgagor is commonly known as the borrower or debtor – the person who receives the mortgage loan.

Mortgage Broker:

Mortgage Broker:

A mortgage broker is a person who acts as the middleman, brokering loans on behalf of borrowers. As a travel agent, the mortgage broker is an intermediary who shops many lending institutions, pledging to obtain the best rates and terms for the borrower.

Take a look at some suggested local Kamloops mortgage brokers HERE

Loan Officer:

If you don’t use a mortgage broker, but deal directly with the lender, the loan officer is the first person you’ll meet. She is the person who will help you obtain a loan preapproval and compile all the documents you will need to get a mortgage. This person is the lender’s point of contact for you, your real estate agent, and the other folks involved in your home purchase.

CLICK HERE TO TRY OUR FREE ONLINE HOME VALUATION TOOL

CLICK HERE TO TRY OUR FREE ONLINE HOME VALUATION TOOL

Loan Processor:

After you fill out all the paperwork, the loan officer sends it to the loan processor who then follows your mortgage from preapproval to closing. He checks all your information for accuracy and verifies your credit and income. He then inputs your information into their in-house system and packages everything for the underwriter.

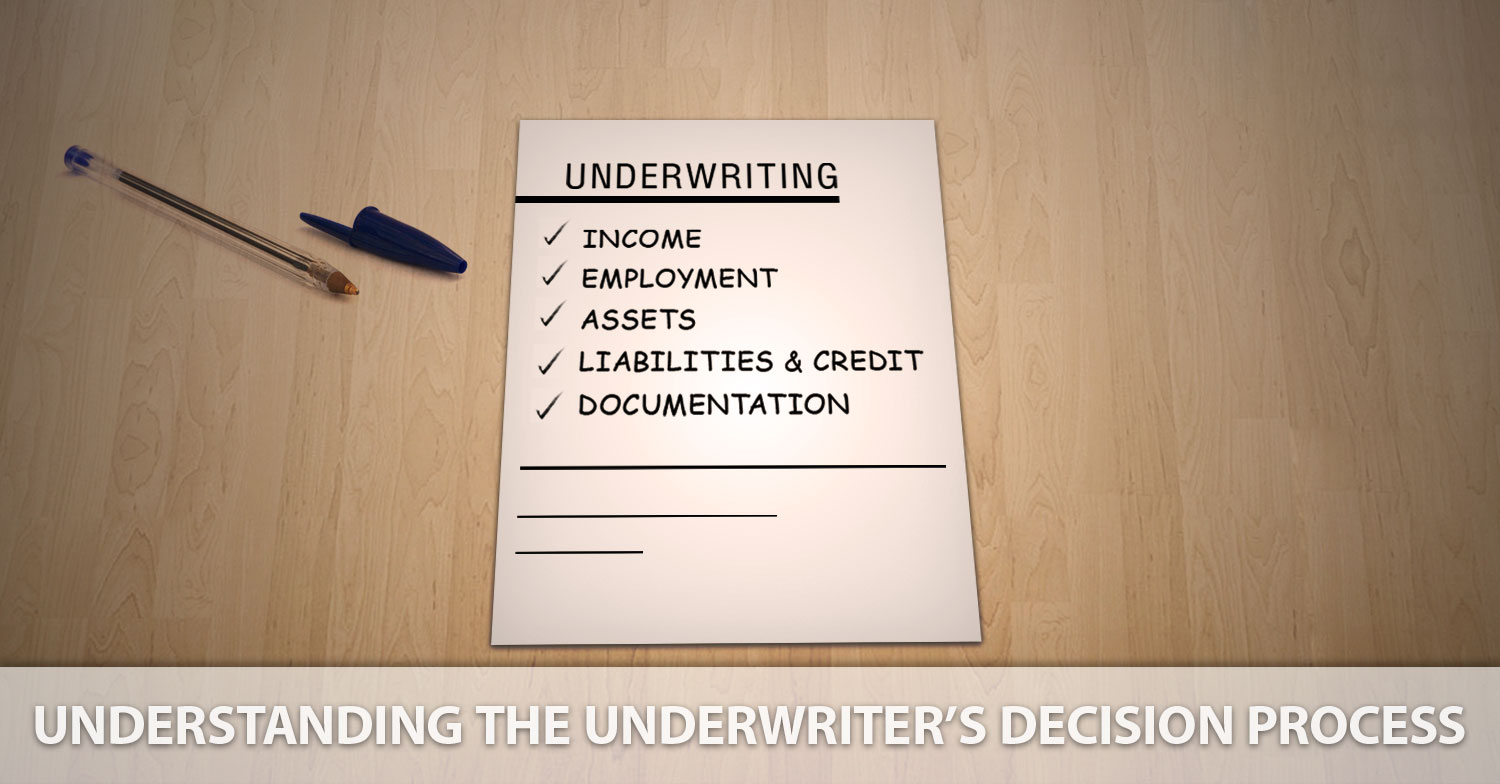

Underwriter:

The underwriter is the one you would wine and dine if you knew who she was. She is the person who determines the lender’s risk in lending to you. She’ll analyze your income to determine if you can pay for the loan. She will look at your payment history to figure out if you’re the type of person who meets his financial obligations. Finally, the underwriter will evaluate the home you want to purchase to ensure that it’s worth the amount you are borrowing.

The underwriter is the one you would wine and dine if you knew who she was. She is the person who determines the lender’s risk in lending to you. She’ll analyze your income to determine if you can pay for the loan. She will look at your payment history to figure out if you’re the type of person who meets his financial obligations. Finally, the underwriter will evaluate the home you want to purchase to ensure that it’s worth the amount you are borrowing.

Appraiser:

The appraiser is the underwriter’s tool to determine how much the house is worth. All lenders sub-contract or employ licensed appraisers who use some methods to determine the home’s market value.

Escrow Company

The escrow company’s primary duty is to receive and disburse funds based on what is mandated in the contract. Escrow companies are independent third parties and can do nothing unless both sides to the transaction are in agreement. In Kamloops, the Broker that represents the seller usually acts as the Escrow Company, if it is a sale by owner one of the lawyers that represents one of the parties involved in the transaction usually hold the escrow deposit

The escrow company’s primary duty is to receive and disburse funds based on what is mandated in the contract. Escrow companies are independent third parties and can do nothing unless both sides to the transaction are in agreement. In Kamloops, the Broker that represents the seller usually acts as the Escrow Company, if it is a sale by owner one of the lawyers that represents one of the parties involved in the transaction usually hold the escrow deposit

Title Company:

Title companies check the chain of title on the home. This is a list of everyone who has ever owned the home – the historical transfers of title. The title officer checks to ensure that the person who is selling the house actually owns it and whether or not there are liens on the property.

Now that you’re familiar with the players, let’s take a look at some of the more common mortgage terms you may hear during your home purchase.

The Loan:

Amortization:

The amount of time you hold the loan, amortization is sometimes called the repayment period.

Principal:

The amount you originally borrow.

PITI:

An acronym for principal, interest, taxes and insurance. This is your monthly mortgage payment.

Part of Understanding Mortgage Terminology is to comprehend The Fees involved:

Closing Costs:

Closing Costs:

Expenses incurred in financing the home. Closing costs vary and some are negotiable.

Point:

What the lender charges for originating the loan. One point equals 1 percent of the loan amount.

Escrow Impounds:

You will be asked to prepay taxes and insurance when escrow closes. This money goes into an escrow account and is used to ensure the timely payment of these bills. The lender may require up to two months of payments to be impounded.

Private Mortgage Insurance:

Called PMI for short, this is an insurance policy that the borrower pays for, but it benefits the lender in the event the borrower defaults on the loan. Lenders typically require PMI when the loan-to-value ratio exceeds 80 percent.

There are three different Canadian mortgage insurance providers:

© http://activerain.com/blogsview/4828952/mortgage-terminology

© http://www.buffaloniagaraproperties.com/