BC real Estate Facts and Forecast for 2021

Posted by Steve Harmer on Tuesday, December 29th, 2020 at 10:59am.

What will Kamloops Real Estate do in 2021? Is it time to sell or buy your Kamloops real estate?

What will Kamloops Real Estate do in 2021? Is it time to sell or buy your Kamloops real estate?

Read what the BC Real Estate Association thinks and the stats for 2020

Fourth Quarter – November 2020

The COVID-19 pandemic and associated recession have impacted housing markets in unexpected and unpredictable ways. Despite what may be the worst recession in BC history, the housing market had a record fall season and prices are rapidly rising as pent-up demand floods into an under-supplied market.

As that pent-up demand from the loss of a spring season fades, sales will likely slow from their current pace, but activity is expected to remain strong as record-low mortgage rates and a recovering economy continue to drive sales.

The average Canadian 5-year fixed rate has fallen to under 2 per cent, the result of a rapid and overwhelming policy response to the COVID-19 pandemic from the Bank of Canada. The Bank has signalled that it may hold its policy rate at its effective lower bound of 0.25 per cent until as late as 2023 and will continue its quantitative easing program until the Canadian economy is on a sustained path to full recovery. The combination of those actions by the Bank of Canada should keep mortgage rates very low for the foreseeable future.

The BC economy is showing signs of recovery, though that recovery is very much K-shaped in that some sectors are recovering at a much faster rate while others continue to languish. Higher-wage sectors have seen employment fully regain pre-pandemic levels, which partially explains the continued strength of the ownership market in BC. Positive developments in the search for a COVID-19 vaccine will help broaden the recovery in 2021 and allow for a normalization of immigration to BC. Those factors will further boost the already strong housing demand.

On the supply side, active listings remain low due to hesitation on the part of sellers to list during the pandemic. Some additional supply may come online following the end of mortgage deferral programs, but given the tightness of market conditions, that supply is unlikely to be disruptive.

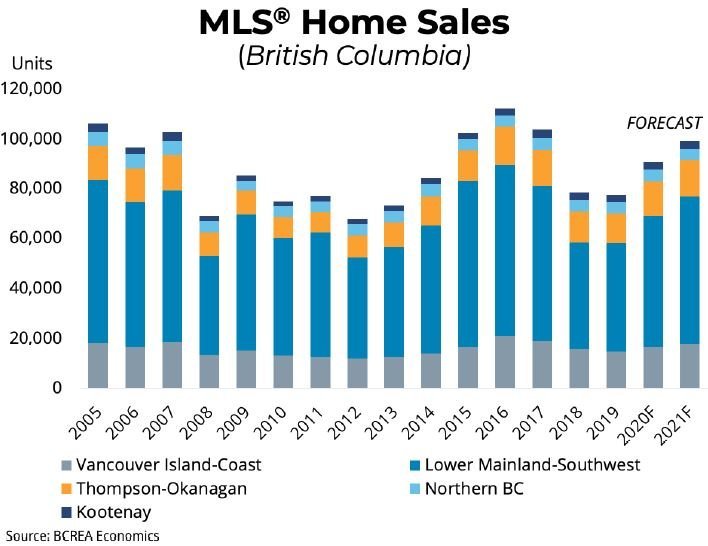

A strong second half of 2020 has sales on pace to reach 90,450 units. We anticipate strong momentum heading into 2021, with sales ultimately rising 9.7 per cent to 99,240 units. The provincial MLS® average price will finish the year up 9.9 per cent before rising a further 2.6 per cent in 2021.

ECONOMIC OUTLOOK

The COVID-19 recession has battered many sectors of the BC economy, forcing the closure of small businesses and restaurants, halting the flow of international tourism and causing an unprecedented rise in unemployment. As a result, we expect that BC’s real GDP will decline in 2020 by 5.5 per cent, the second worst recession in the province’s history.

The severity of the COVID-19 recession alone makes it stand out in comparison to previous business cycles, but there are many other ways in which the COVID-19 recession has been far from typical. The speed and scale of job losses experienced in the spring were unlike anything the province has experienced in past recessions.

The BC economy shed close to 400,000 jobs in the first two months of the pandemic, prompted by a shutdown of economic activity to help contain the spread of COVID-19. As more was learned about how to mitigate the spread of the virus, the economy entered a re-opening phase, allowing businesses to resume operations and workers to return to jobs. While the BC economy has been recovering lost jobs for several months, there is still a long way to go to get back to normal. Employment remains 4 per cent below pre-pandemic levels and the provincial unemployment rate, though improved, remains elevated.

Despite a high unemployment rate, consumer spending has largely recovered. Provincial retail sales have already returned to pre-pandemic levels, and the housing market is posting its strongest sales in years.

Both of those developments can be at least partially traced to the unusual impacts of this recession on the labour market, and the rapid and overwhelming response from policymakers.

One of the defining characteristics of the COVID-19 recession is the asymmetric impact on the labour market. The heavy burden of job losses has occurred in front-line service sector employment, particularly in the hospitality and restaurant industries. Looking deeper at employment impacts by wage tiers, there is a stark difference in the experience of this recession for high-wage sectors versus low-wage sectors.

These employment impacts are far from the norm. In past recessions, the BC economy has experienced relatively uniform job losses across all sectors. Indeed, data from past recessions shows the impact on low-wage sectors is often more muted. However, in the COVID-19 recession, those jobs have been hit the hardest by far, while employment in above-average wage sectors has risen back to pre-COVID-19 levels.

While lower-income households have seen spending rise due to government transfers like the Canada Emergency Response Benefit (CERB), high-income households are not spending at their usual rate. With fewer retail stores open for shopping, and limited travel opportunities, as well as some added precautionary savings, the second quarter of 2020 saw an extraordinary increase in household savings rates.

The Canadian household savings rate climbed to a record high of 28.2 per cent in the second quarter, eclipsing the previous record of 21.2 per cent in 1982. As a result, many households have not experienced the type of financial vulnerability you would normally observe in a recession, particularly in one as severe as 2020.

Because employment in higher-wage sectors that support homeownership has been largely unscathed, and given actions by the Bank of Canada to dramatically lower borrowing costs, activity in the housing market has more than recovered its pre-pandemic levels. In past recessions, BC home sales typically posted an initial steep decline before bouncing back along with the wider economy.

On average, that recovery has taken place over more than a year. In contrast, the COVID-19 recession has seen a remarkably swift rebound in home sales, not only to pre-COVID-19 levels but to multi-year highs. At the same time, households have been wary to list their home for sale during the pandemic, and those that may have been forced to sell due to unemployment or loss of income have benefited from CERB and the CMHC mortgage deferral program. As a result, we have seen rising sales activity and a falling supply of listings, which has led to rising home prices.

An unexpectedly strong housing market has meant that residential construction, typically a sector that posts dramatic declines during recessions, has continued largely unabated. Housing starts in BC are on track to reach about 37,000 units this year, down from 2019’s record, but still a strong level of new home construction.

As the economy continues to heal, major capital projects resume, and a successful vaccine becomes available, employment will continue to recover, particularly in those parts of the economy with the greatest exposure to the pandemic. We expect a strong recovery for the BC economy in 2021, with real GDP growth, perhaps exceeding 4 per cent. However, that recovery is very likely to be K-shaped, in that some sectors will grow at a much faster rate while others continue to languish. It will therefore require significant government support, both provincially and federally, to bridge the pandemic and post-pandemic economies.

BCREA Housing Forecast

Housing markets across the Thompson-Okanagan region, serviced by the South Okanagan Real Estate Board, the Okanagan Mainline Real Estate Board, and the Kamloops and District Real Estate Association, fully recovered from the pandemic that halted home sales in the spring. Pent-up demand from inactivity during the initial phase of the pandemic translated into stronger than average sales in the summer and fall.

By the end of September, employment in the Thompson- Okanagan region was 3 per cent above pre-pandemic levels. However, employment has not yet recovered in hard-hit sub-sectors such as accommodation/food services, transportation, retail and construction. Compared to the same time last year, employment is down by 5 per cent.

While there is concern over the rising number of COVID-19 cases across the province, we expect momentum in MLS® sales to continue into next year given prevailing demand and record-low mortgage rates. We are forecasting home sales in the South Okanagan area will finish the year up by 24.4 per cent, and by 6.8 per cent in 2021 to 2,350 units.

The Okanagan Mainline area is expected to experience a rise of 15 per cent by the end of 2020, and by another 5.9 per cent in 2021 to 9,000 units. Kamloops home sales are forecast to increase by 2.9 per cent this year, and by 8.1 per cent in 2021 to 3,200 units.

While demand is anticipated to remain relatively strong in 2021, the supply of active listings remains low throughout the region as potential sellers continue to put off listing their properties and new listings are quickly absorbed by surging demand.

Government support and mortgage deferral programs also helped to prevent financially vulnerable households from being forced to sell. As a result, market conditions have tightened, and prices are accelerating by double digits across the Thompson-Okanagan.

As a result, the MLS® average prices at the end of 2020 will be up by 14.5 per cent in South Okanagan, 11.5 per cent in the Okanagan Mainline, and 7.2 per cent in Kamloops. Those outsized increases in average prices are somewhat skewed higher by an uptick in the share of single-detached homes, as buyers increasingly desire extra space.

Strained supply across the Thompson-Okanagan region is unlikely to be relieved anytime soon, as housing starts are forecast to decline by 60 per cent in Penticton and by 2.6 per cent in Kamloops, but are expected to increase slightly in Kelowna by 3.4 per cent.